Achieve Your Law Firm's Vision

LawFirmOS transforms big goals into measurable milestones, giving you the structure, tracking, and automation to build the firm you always envisioned.

Daydreams and Spreadsheets Aren’t a Growth Strategy

Intuition and hard work got you here, but true growth requires real structure and control. LawFirmOS provides the system to scale effectively while supporting your staff, hitting growth goals, and creating a winning office culture.

Chaos or Control? It's Your Choice.

Eliminate the chaos of managing your law firm with clunky spreadsheets, decaying CRMs, and scribbled post-it notes. Discover the efficiency that comes from having everything you need in one place, allowing you to serve your clients better and streamline your operations.

A Centralized System for Law Firm Management

Scale your law firm, optimize operations, and stay on top of every moving part of your practice.

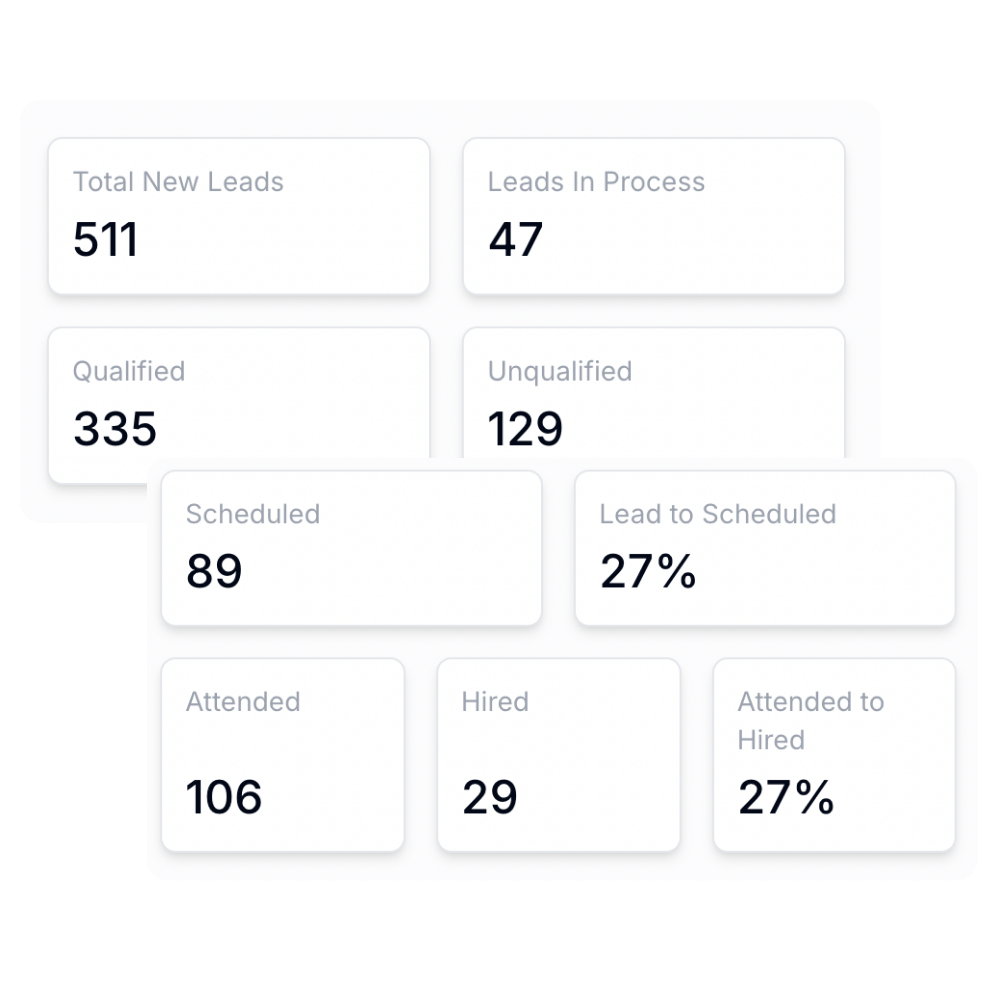

Track what matters. Real-time KPI tracking: Revenue, conversion rates, employee performance, and more.

Get a grip. One dashboard for everything : Manage HR, sales, marketing, and case progress in one place.

Reach your milestones. Measure and achieve firm-wide, departmental, and individual initiatives.

Improve sales and marketing. Capture, track, and convert more leads with measurable ROI, referral tracking, and event management.

Measure every client touchpoint. Build and track a branded client journey from intake to resolution, creating raving fans for your firm.

Create a winning culture. Run more effective meetings, get staff buy-in, and quickly resolve client issues before they turn into fire drills.

Our White Glove Onboarding Experience All But Guarantees Your Success

Kickoff & Planning

We map out your workflows, set priorities, and start gathering data, so there’s no scrambling later.

Core Set-Up and Customization

Your system is tailored, automations are configured, and historical data is migrated, because what’s the point of a platform if it doesn’t work for you?

Rollout & Team Adoption

Training, structured feature rollouts, and live support ensure your team actually uses the system instead of avoiding it.

Go From Strategy To Success

Maybe you have tried to implement new processes, hire consultants, or sign up for exciting new SaaS products only to watch your efforts come to a slow and painful death. At Modern Law Practice, we're changing the model so you actually achieve your objectives.

Tailored For You

Unlike other SaaS providers, we dig into your firm's workflows, tailor the platform to your needs, and make sure your team is set up for success.

Scalable Pricing

Give your team the benefits of working with a highly paid business consultant without the price tag.

Performance-Based

Hit your milestones, and your monthly rate drops. Yes, we reward firms that stay on track and actually use our platform.

What's Not To Love?

.png)

Manage and Track the Client Journey

Streamline intake, map out milestones, and measure NPS scores for every client that walks through your door.

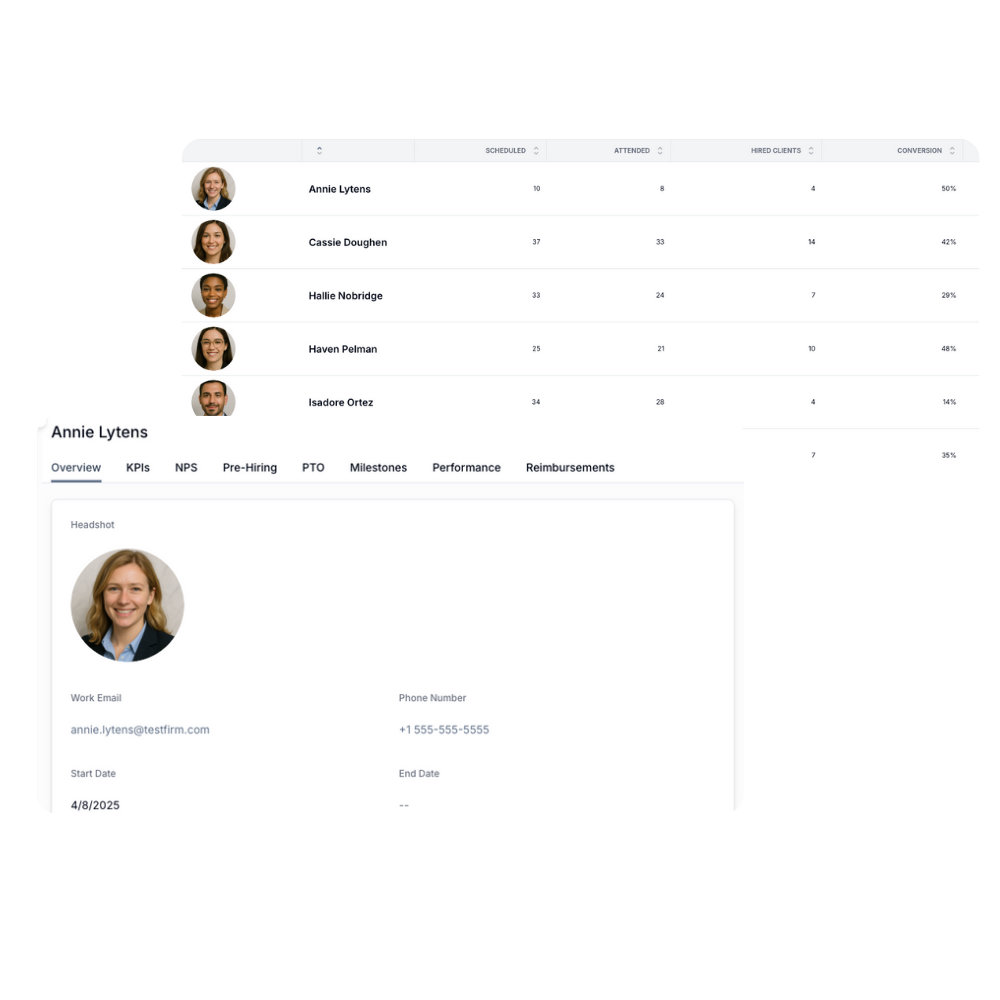

Build and Support a Winning Team

Identify and reward your A players while supporting and training new team members with performance-based metrics gathered directly from your clients and revenue.

Scale Marketing With Confidence

Ideate, plan, and execute marketing strategies across digital and traditional channels. Then measure every dollar and every lead to maximize the ROI on your efforts.